In today’s fast-paced, digital-first world, small and medium-sized businesses (SMBs) face an ever-evolving landscape of challenges and opportunities. From the surge in digital business models to the complexities of hybrid work, businesses must remain agile, efficient, and connected to thrive. Microsoft Dynamics 365 Business Central offers an all-in-one CRM platform that empowers companies to adapt faster, work smarter, and achieve better results in an increasingly competitive market. KMicro, a preferred Microsoft partner, can help business leaders unravel the complexities of moving to a CRM or transferring from an existing CRM to the powerful Dynamics 365 Platform.

The Reality of Business Today: Adapt or Get Left Behind

To stay competitive in today’s business environment, organizations need tools that support flexibility, efficiency, and data-driven decision-making, which is where Dynamics 365 shines. Consider these recent statistics that reflect the current landscape:

- Financial Reporting Challenges: Single-entry manual accounting systems often result in incomplete financial statements, making it difficult to accurately assess a business’s financial position and potentially leading to misguided strategies. (Accounting Insights)

- Employee Preferences for Flexible Work:

- Impact of Manual Accounting Systems:

- Operational Inefficiencies: Manual accounting processes can reduce employee engagement and productivity, with actively disengaged employees costing organizations $3,400 for every $10,000 of salary. (SF Magazine)

Traditional, manual accounting systems have left many businesses lagging, plagued by inefficiencies that limit growth and employee satisfaction. A lack of digitization can lead to increased operational costs, reduced profits, and ultimately, dissatisfied customers. Dynamics 365 Business Central is designed to address these issues, enabling businesses to move beyond limitations.

Microsoft Dynamics 365 Business Central: A Unified Solution for Growth

Microsoft Dynamics 365 Business Central tackles these modern challenges by integrating critical business functions—sales, finance, service, and operations—into a single, cloud-based platform. This unified solution facilitates collaboration, data-driven decision-making, and agility to respond to market changes.

Key Features Include:

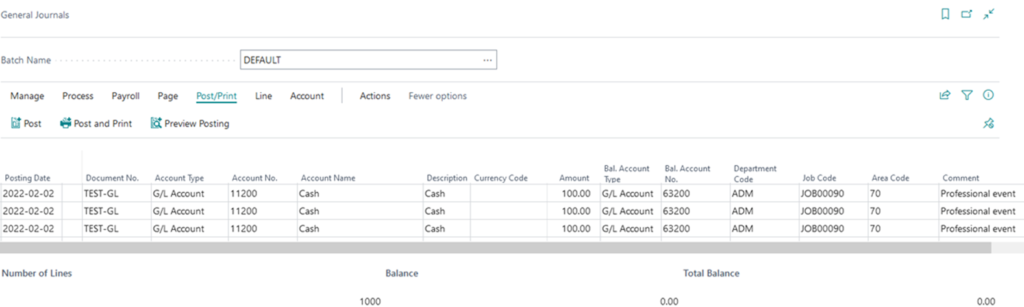

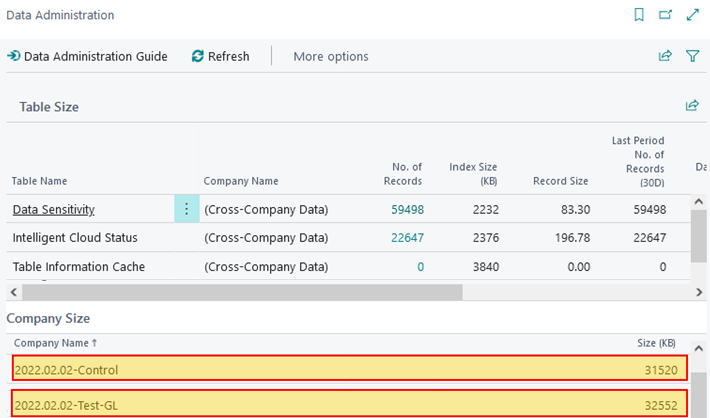

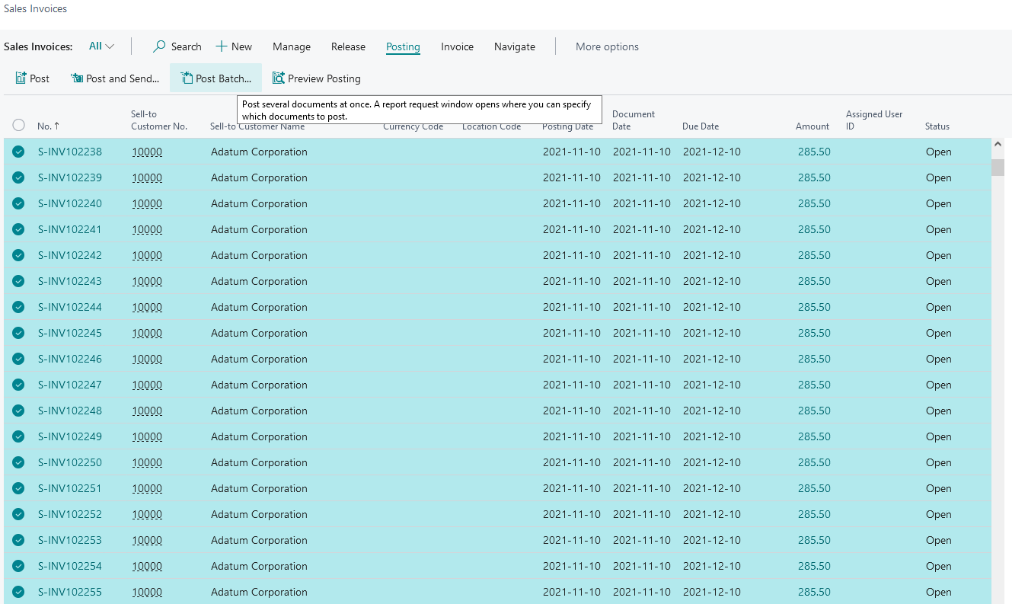

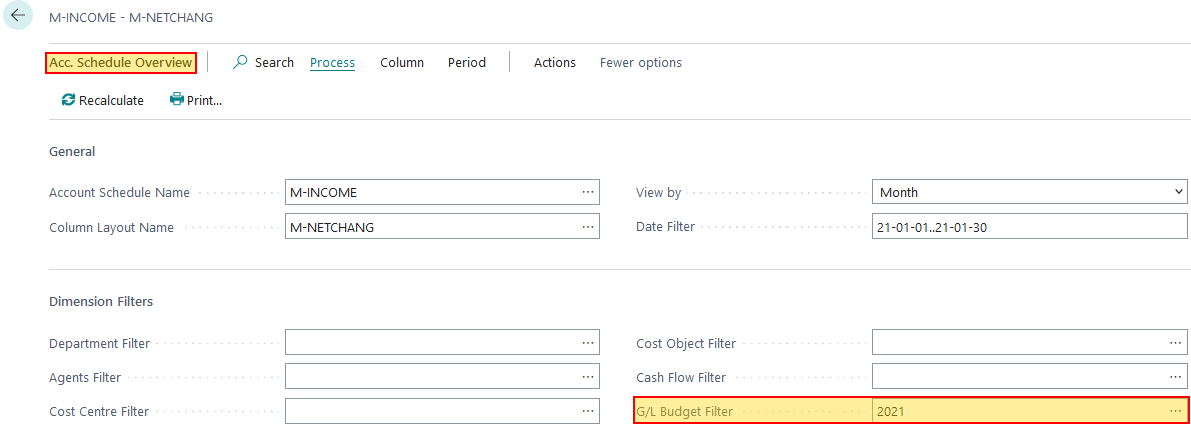

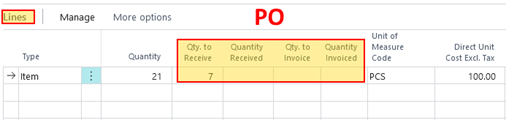

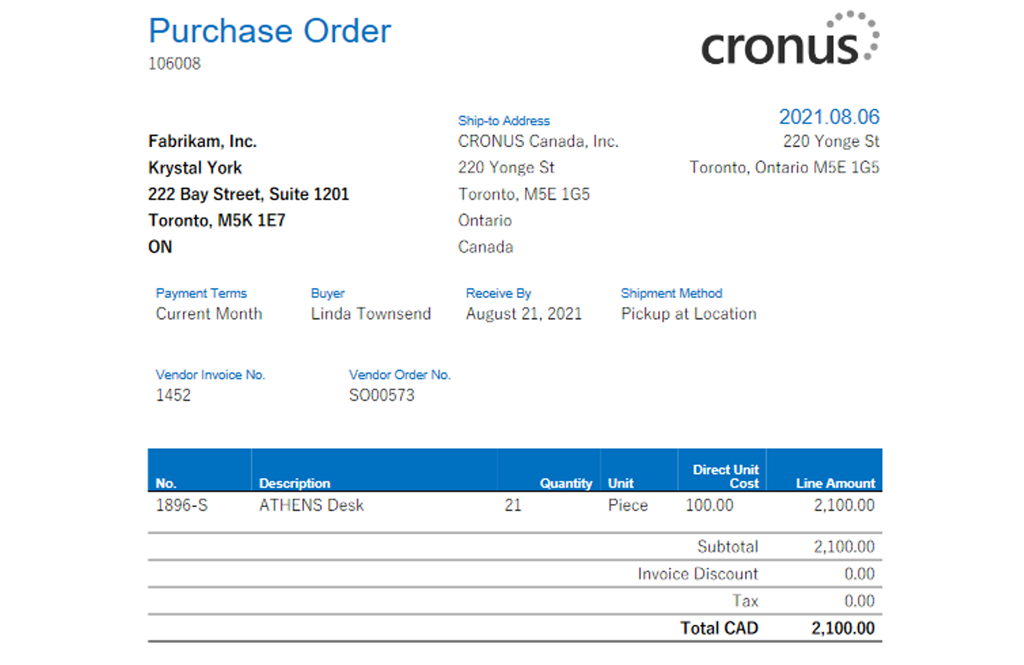

- Financial Automation: Automate processes like bank account reconciliation, fixed asset tracking, and cash flow forecasting, streamlining financial management.

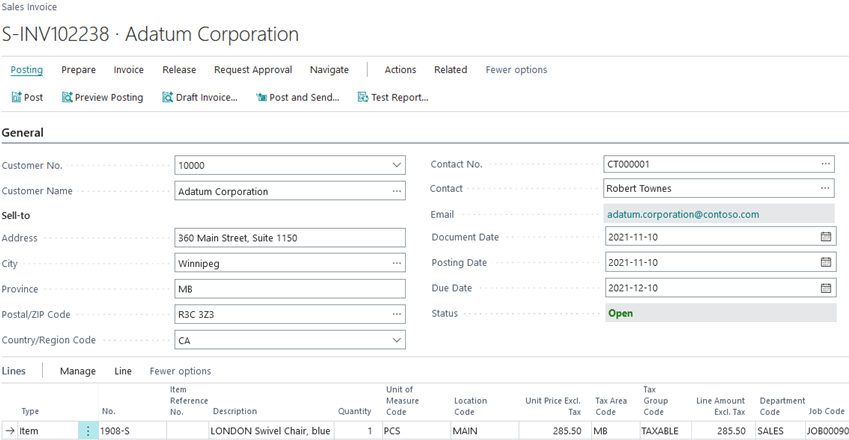

- Sales Intelligence: Connect sales data to customer insights and streamline transactions through integrations with familiar tools like Outlook.

- Enhanced Service Management: Track and optimize customer service interactions for a seamless experience across all touchpoints.

- Advanced Reporting & Insights: Harness AI-powered data analytics to generate actionable business insights in real-time.

- Efficient Project Management: Improve project delivery with intelligent planning, cost tracking, and enhanced budget accuracy.

Explore how financial automation can benefit your business—contact us for a free assessment!

Benefits of Dynamics 365 Business Central

The platform’s capabilities yield tangible results, as demonstrated by the successes of current users:

- Call2Recycle: Reduced costs by $25,000 annually through streamlined financial processes and end-to-end management across sales, invoicing, and inventory tracking.

- CURRAX: Achieved 12% year-over-year growth by enhancing remote collaboration and resource management, supported by Dynamics 365’s robust collaboration tools.

Seamless Integration for Enhanced Efficiency

Microsoft Dynamics 365 Business Central offers seamless integration with widely used Microsoft tools like Excel, Teams, and Outlook. This interoperability streamlines daily tasks by keeping teams connected and productive without requiring multiple logins or switching between applications. For example:

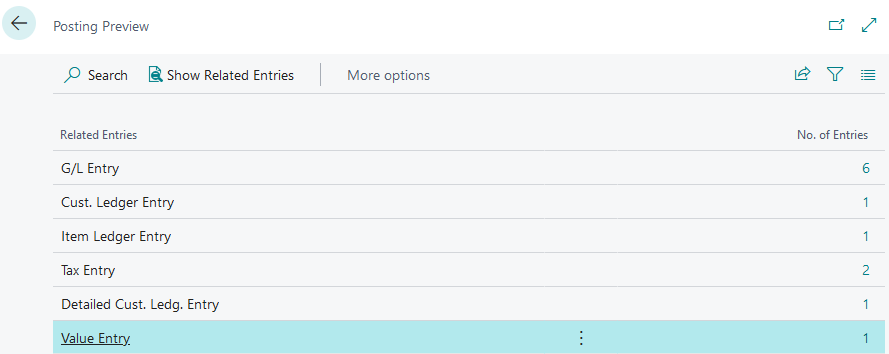

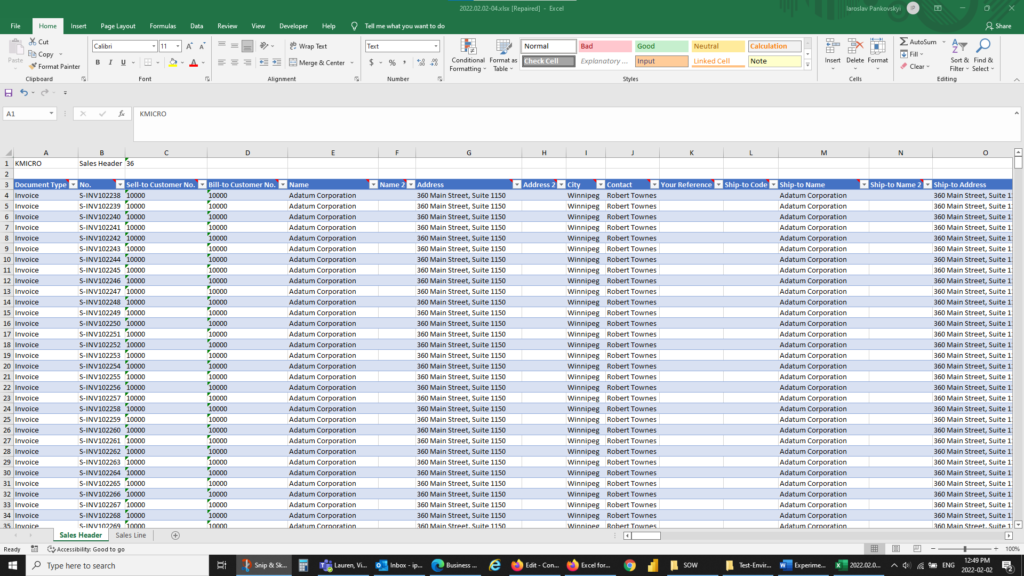

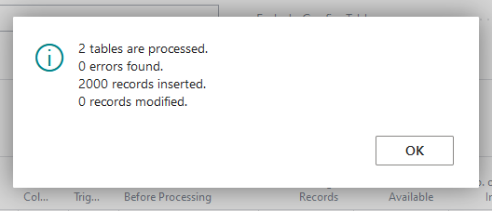

- Excel: Update and share data seamlessly between Excel and Business Central, allowing efficient data entry and customized report layouts.

- Outlook: Manage customer inquiries, generate quotes, and complete transactions directly from Outlook, accelerating the sales process.

- Teams: Share insights, customer data, and business updates in real time, improving communication and decision-making across departments.

More than just software, Microsoft tools can utilize the power of Microsoft’s AI “CoPilot” to accelerate your business success. KMicro’s CoPilot experts are ready to guide you through the right implementation to keep your business information secure.

Scalable, Secure, and Built for the Future

With robust compliance and security measures, Dynamics 365 Business Central ensures business continuity and reliable disaster recovery. Its cloud-based, scalable system supports operations in over 130 countries with multi-currency capabilities and compliance with local regulations.

Ready to future-proof your business? Contact KMicro today for a free, no-obligation assessment and discover how Dynamics 365 Business Central can transform your operations.

Transform Your Business with AI-Driven Insights

Leveraging the power of AI, Dynamics 365 Business Central includes Copilot capabilities that assist in generating insights, predicting cash flow needs, and anticipating late payments. These intelligent features enable faster decision-making and free up valuable time for your employees to focus on strategic initiatives.

Unlock the Power of a Connected Business with Dynamics 365

If your business is ready to break free from the constraints of traditional systems and embrace a digitally connected, agile solution, Microsoft Dynamics 365 Business Central is your key to growth. Gain insights into every aspect of your operations, drive collaboration across teams, and be prepared to pivot with market changes. Dynamics 365 Business Central empowers every team to work smarter, adapt faster, and perform better.

Start your journey with Dynamics 365 Business Central today. Contact KMicro for a free assessment.